MUSCAT: The Central Bank of Oman (CBO) is weighing efforts to support the launch of the International Bank Account Number (IBAN) system in the Sultanate – a globally recognised code designed to identify overseas bank accounts when sending or receiving international payments.

The move is among a slate of initiatives currently being studied by the Sultanate’s apex bank to underpin the development of a robust payment infrastructure integrated seamlessly, efficiently and safely with regional and international payment systems.

Those initiatives also include plans for the establishment of a National Payment Company to operate retail payments, and the launch of an awareness and marketing drive highlighting the benefits of electronic payments over conventional payment methodologies, CBO Executive President Taher Salim al Amri said at a banking forum held in the city last week.

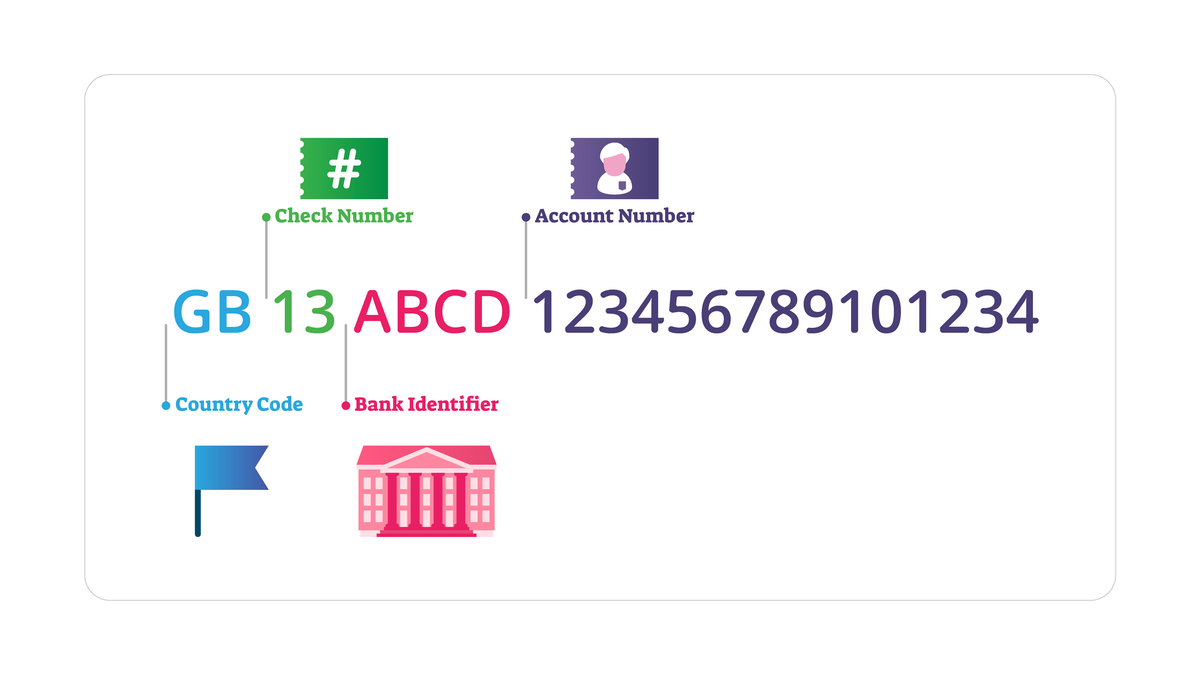

According to experts, the proposed inclusion of the Sultanate in the globally accepted IBAN system will strengthen Oman’s integration into the international payments architecture. An IBAN is an alphanumeric code typically comprising of up to 35 letters and numbers written in a standardised format. Incorporated into this code are characters that identify the specific bank and country that a payment is remitted to, thereby ensuring that international transfers are speedy, convenient, automatic and error-free.

As many as 78 countries around the world, including all of the European Union (EU) countries, are part of the IBAN system. The list, however, does not include the United States and Canada, which nonetheless recognise and process payments in accordance with the IBAN system.

Some experts insist that IBAN has many advantages over the more widely accepted SWIFT (Society for World Interbank Financial Telecommunication) code, which is an internationally recognised system for identifying bank accounts when making cross-border payments. A global network in its own right, SWIFT is used throughout the financial world to make payments.

But unlike SWIFT codes, which are used primarily to identify a specific bank or branch, the IBAN code specifies the country, bank and account number of the recipient account. Both systems however complement each other and are at the heart of international money transfers and cross-borders payments in today’s world.

Oman Observer is now on the WhatsApp channel. Click here