Personal loans disbursed by commercial banks climbed to RO 10.242 billion in 2019, up from RO 10.006 billion a year earlier, the Central Bank of Oman (CBO) stated in its 2019 Annual Report released here this week.

Banks can provide personal loans up to 40 per cent of their total loan portfolio in line with CBO regulations.

However, with banking credit growing year-on-year, the volume of disbursals in the form of consumer loans has grown as well.

“Notwithstanding the economic slowdown, bank credit growth remained reasonable at 3.1 per cent during 2019,” the apex bank said.

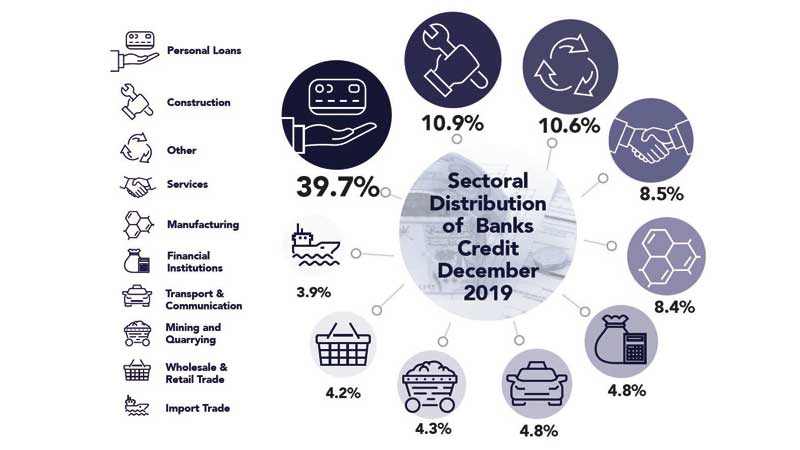

“Personal loans continued to hold the major share in total credit that stood at 40 per cent (RO 10.2 billion) in 2019,” it noted.

Personal loans – broadly categorising all types of consumer credit – have been growing at an annual rate of about 5 per cent in recent years, buoyed by robust appetite on the part of retail customers, and relatively easy and competitive lending terms by banks.

Disbursed typically to salaried employees of public and private sector organisations, personal loans may be utilised towards, among other things, home purchases or improvements, tuition and other education services, travel, purchases of cars or other consumer durables, settling of credit card dues, and so on. Personal loans rose from RO 9.123 billion in 2016 to RO 9.642 billion a year later.

A distant second came the construction sector, which received RO 2.803 billion in credit last year, representing 10.9 per cent of total banking credit of RO 25.830 billion.

Other economic sectors benefiting from banking credit last year were: Services RO 2.193 billion (8.5 per cent), manufacturing RO 2.173 billion (8.4 per cent), electricity – gas – water RO 1.302 billion, financial services RO 1.244 billion, transport and communications RO 1.240 billion, mining and quarrying RO 1.113 billion, and wholesale and retail trade RO 1.075 billion.

The Central Bank cautioned however that sector-wise classification of credit may “lack precision due to the inability of banks to identify the exact end-use” notably because borrowers may be engaged in multiple activities spread across diverse industrial groups.

Banks are also required to set aside at least five per cent of their credit towards funding the requirements of small and medium enterprises (SMEs) in the Sultanate.

CONRAD PRABHU

@conradprabhu

Oman Observer is now on the WhatsApp channel. Click here