MUSCAT, July 17 - Expatriate remittances, which have grown consistently year on year, declined for the first time last year in trend with the general economic downturn, the Central Bank of Oman (CBO) said in newly released 2016 Annual Report.

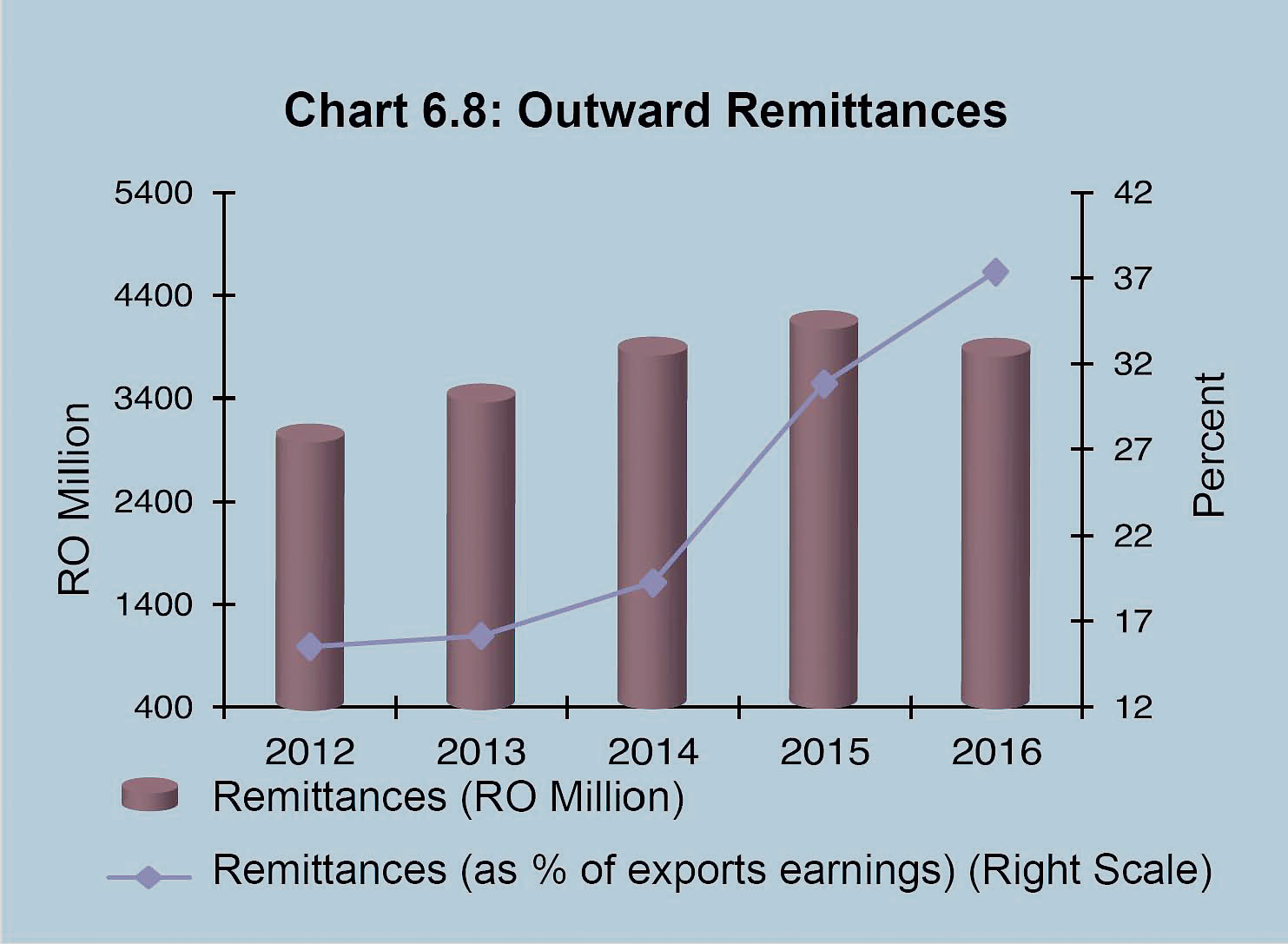

Capital outflows attributed to worker-related remittances fell 6.5 per cent to RO 3.952 billion last year, down from a peak of RO 4.226 billion recorded a year earlier. It marks the first time in more than two decades that the uptrend in remittances has been reversed, figures released by the apex bank show.

While the constrained economic environment linked to the slump in global oil prices has been a key factor contributing to the decline, experts also allude to the changing demographic profile of Oman’s expatriate population.

Blue collar workers make up a growing proportion of the Sultanate’s guest workforce, their numbers boosted by the demand for low and semi-skilled construction, contracting and maintenance workers necessary to implement major oilfield, petrochemical, tourism and infrastructure projects.

The decline puts the brakes on a strong uptrend in remittances that has grown at an average rate of 10 - 15 per cent annually, particularly over the last decade. Worker-related remittances surged from RO 2.193 billion in 2010 to RO 2.774 billion a year later. In 2012, the figure jumped to RO 3.109 billion, climbing to RO 3.501 billion in 2013 before topping RO 3.961 billion in 2014. It crossed the RO 4 billion mark in 2015.

The Central Bank report said: “A large chunk of the gross domestic saving was remitted out of the country in the form of current transfer i.e., remittances by the expatriate workers in Oman (about RO 4 billion) and investment income i.e., net interest and dividend paid on external liabilities. Oman’s gross national saving as percentage of GDP dropped to 20.1 per cent in 2015 compared to gross domestic saving rate of 39.5 per cent, implying leakage of savings out of the country to the extent of 19.4 per cent of GDP.”

The report further added: “Oman had been a net exporter of capital in the recent years which is corroborated by surplus observed in the current account of the country’s balance of payments. There has been a reversal in this regard as the estimate for the current account balance pointed to a deficit of RO 4.7 billion during 2016 as compared to a deficit of RO 4.2 billion during the previous year.”

Under a longstanding policy of Oman’s free market economy, there are no restriction on remittances abroad of equity, debt, capital, interest, dividends, profits and personal savings.

Conrad Prabhu

Oman Observer is now on the WhatsApp channel. Click here