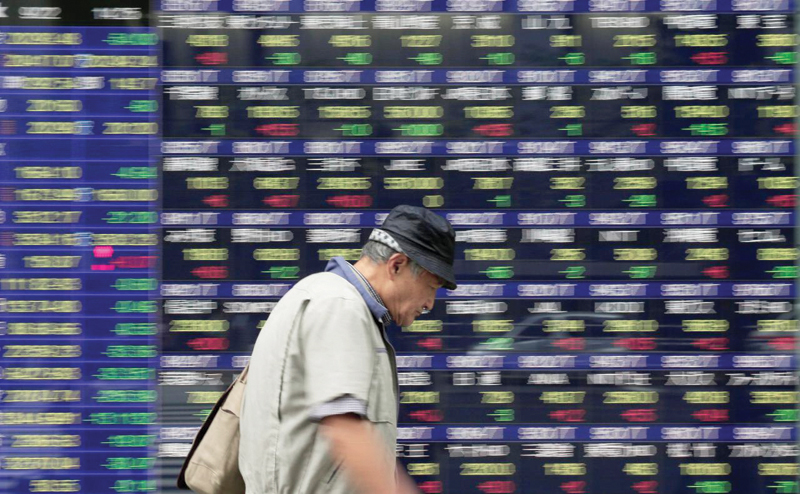

TOKYO: Asian shares were steady on Thursday, taking their cue from strong US data though many markets failed to build on early gains in holiday-thinned trade and due to uncertainty about the impact of recent hurricanes on the US economy. Japan’s Nikkei and Australian shares both ended flat.

MSCI’s broadest index of Asia-Pacific shares outside Japan was almost flat with Hong Kong and South Korea, as well as mainland China, closed for public holidays. European shares were expected to be steady to slightly weaker, with Germany’s Dax futures down 0.2 per cent while France’s Cac futures and Britain’s FTSE futures were flat. Wall Street’s three major stock indexes hit fresh highs on Wednesday as did MSCI’s all-country world stock index .

The Institute for Supply Management’s index of non-manufacturing activity rose to 59.8 in September, its highest reading since August 2005, pointing to the resilience of the vast US services sector despite disruption from two powerful hurricanes.

The data came after a surge to 13-year high in the survey of manufacturers as well as car sales at 12-year high, both released earlier this week.

“Shares markets were supported as economic data was generally strong,” said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui Asset Management.

But analysts also cautioned that the data reflected temporary demand stemming from repair and replacement spending in the aftermath of the hurricanes. Data from private payrolls processor ADP showed monthly hiring slowed to an 11-month low of 135,000, again due partly to disruptions from hurricanes, although this was better than economists’ median forecast.

Economists expect Friday’s nonfarm payrolls report, one of the most closely watched pieces of economic data in financial markets, to show a similar slowdown. They estimate a payroll increase in September of 90,000, substantially lower than the average over the past year of around 175,000, though some say investors may need to pay attention to state data due on October 20 to exclude the impact from hurricanes.

US bond yields were off their lows as bond prices fell, but yields were held below multi-month peaks hit earlier in the year. The 10-year US bond yield stood at 2.328 per cent US10YT=RR, below Monday’s 12-week high of 2.371 per cent.

“Because US economic data for August to October is likely to be disrupted by hurricanes, markets may show a much smaller response to them,” said Tomoaki Shishido, fixed income analyst at Nomura Securities.

“In that regard, the market will be focusing more on policy issues, such as tax cuts and the choice of the next Fed chair,” he added.

US President Donald Trump proposed a tax overhaul late last month but it remains to be seen whether the plan can get through Congress given the divisions among Republicans.

Trump has promised to decide this month on a new chief for the Federal Reserve to replace Janet Yellen, whose term expires in February.

High-rated bonds were affected by worries about Catalonia’s independence vote from Spain.

The yield on Spanish bonds shot up to the highest level since March as prices fell, stretching the gap over German benchmarks to the widest in more than five months after Catalonia’s secessionist leader said the region will declare independence in “days.”

Spain’s IBEX stock index posted its worst single-day loss in 15 months with a 2.85 per cent decline on Wednesday.

Catalonia will move to declare independence from Spain on Monday while Spanish Prime Minister Mariano Rajoy’s government said Catalonia must to “return to the path of law” before any negotiations could take place. In currency markets, the euro steadied after weakness since late last month and last traded at $1.1761, off Tuesday’s 1½month low of $1.16955. The immediate focus is on the minutes of the European Central Bank’s last policy meeting held on September 7, due to be published at 11:30 GMT. — Reuters

Oman Observer is now on the WhatsApp channel. Click here